how are property taxes calculated in fl

The basic formula is. When it comes to real estate property taxes are almost always based on the value of the land.

Property Tax Prorations Case Escrow

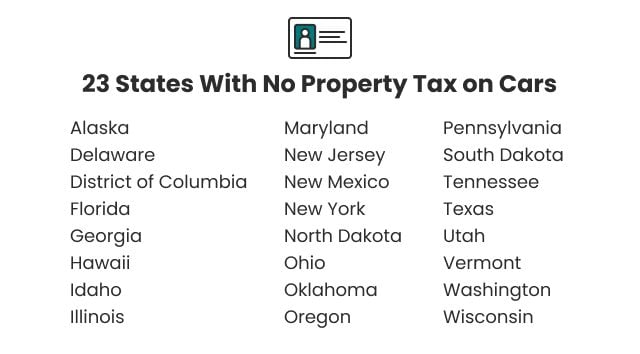

Florida property taxes are computed on the taxable value To obtain the taxable value determine the assessed value of the home less eligible.

. Taxpayers may choose to pay next years 2019 tangibleproperty taxes quarterly. The estimated tax amount using this calculator is based upon the average Millage Rate of 200131 mills or 200131 and not the millage rate for a specific property. Property taxes fund public schools libraries medical services infrastructure and roads.

The market value of your home multiplied by the assessment ratio in your area equals the assessed value of your property for tax purposes. For example Florida real estate taxes are among the lowest in the country but your tax rate will vary depending on the county. The rates are expressed as millages ie the actual rates multiplied by 1000.

If you live in Palm Beach County in a house valued at 370000 after the homestead your property taxes. The median property tax on a 18240000 house is 176928 in Florida. If you would like to calculate the estimated taxes on a specific.

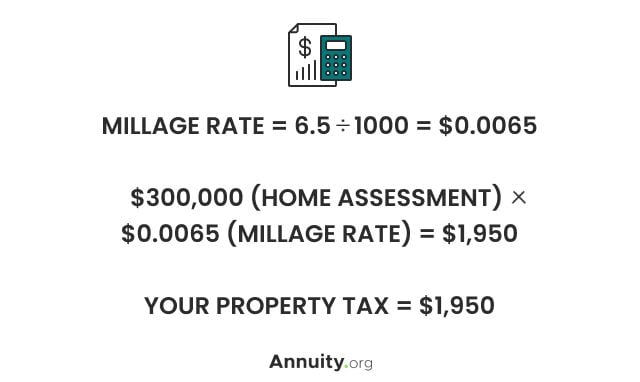

NEW HOMEBUYERS TAX ESTIMATOR. Property taxes are determined by multiplying the propertys taxable value by the millage rate set each year by the taxing authorities. Property Tax in Florida.

Property taxes are calculated by taking the mill levy and multiplying it by the assessed value of the owners property. The value of a piece of. 097 of home value.

So if the assessed value of your home is 200000 but the market value is 250000 then the assessment ratio is 80 200000250000. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys property tax assessor. JustMarket Value limited by the Save Our Homes Cap or 10 Cap Assessed Value.

Florida is ranked number twenty three out of the fifty states in order of the average amount of property. Find the assessed value of the property being taxed. A mill is one-tenth of one percent.

In its simplest form the real property tax is calculated by multiplying the value of land and buildings by the tax rate. How are property taxes calculated in Orange County Florida. Counties in Florida collect an average of 097 of a propertys assesed fair market value as property tax per year.

HOW ARE FLORIDA PROPERTY TAXES CALCULATED. Governments use taxes to provide taxpayers with various services including schools police fire and garbage collection. Property tax is calculated by multiplying the propertys assessed value by the total millage rates applicable to it and is an estimate of what an owner not benefiting from any exemptions would pay.

The local property appraiser sets the assessed value to each property effective January 1st each year. Property tax rates are normally expressed in mills. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on.

Taxable Value X Millage Rate Total Tax Liability For example a homestead has a just value of 300000 an accumulated 40000 in Save Our Homes SOH protections and a homestead exemption of 25000 plus the additional 25000 on non-school taxes. Property taxes are a type of ad valorem taxthe term is Latin for according to valueso it follows that theyre calculated based on an assessment of your propertys value. The median property tax in Florida is 177300 per year for a home worth the median value of 18240000.

The median property tax on a 24750000 house is 267300 in Broward County. Property taxes are calculated by applying an assessment ratio to the propertys fair market value. Local governments levy property taxes on property owners within their locality.

Local property taxes fund schools fire departments and libraries and they can be a major source of funding for your city or county. The assessed value estimates the reasonable market value for your home. The median property tax on a 24750000 house is 240075 in Florida.

For instance if your home is assessed at 190000 and your general property tax rate is 225 then your residences total tax assessment for the tax year would be 4275 225 X 190000100 4275. Tax amount varies by county. The median property tax on a 24750000 house is 259875 in the United States.

This tax estimator is based on the average millage rate of all Broward municipalities. Florida property tax is based on assessed value of the property on January 1 of each year minus any exemptions or other adjustments used to determine the propertys taxable value. A local millage rate a dollar amount per 1000 of.

Add the value of the land and any improvements to determine the total value. The median property tax on a 18240000 house is 191520 in the United States.

What Is Florida County Tangible Personal Property Tax

Capital Gains Tax Calculator 2022 Casaplorer

Real Estate Property Tax Constitutional Tax Collector

Florida Property Taxes Explained

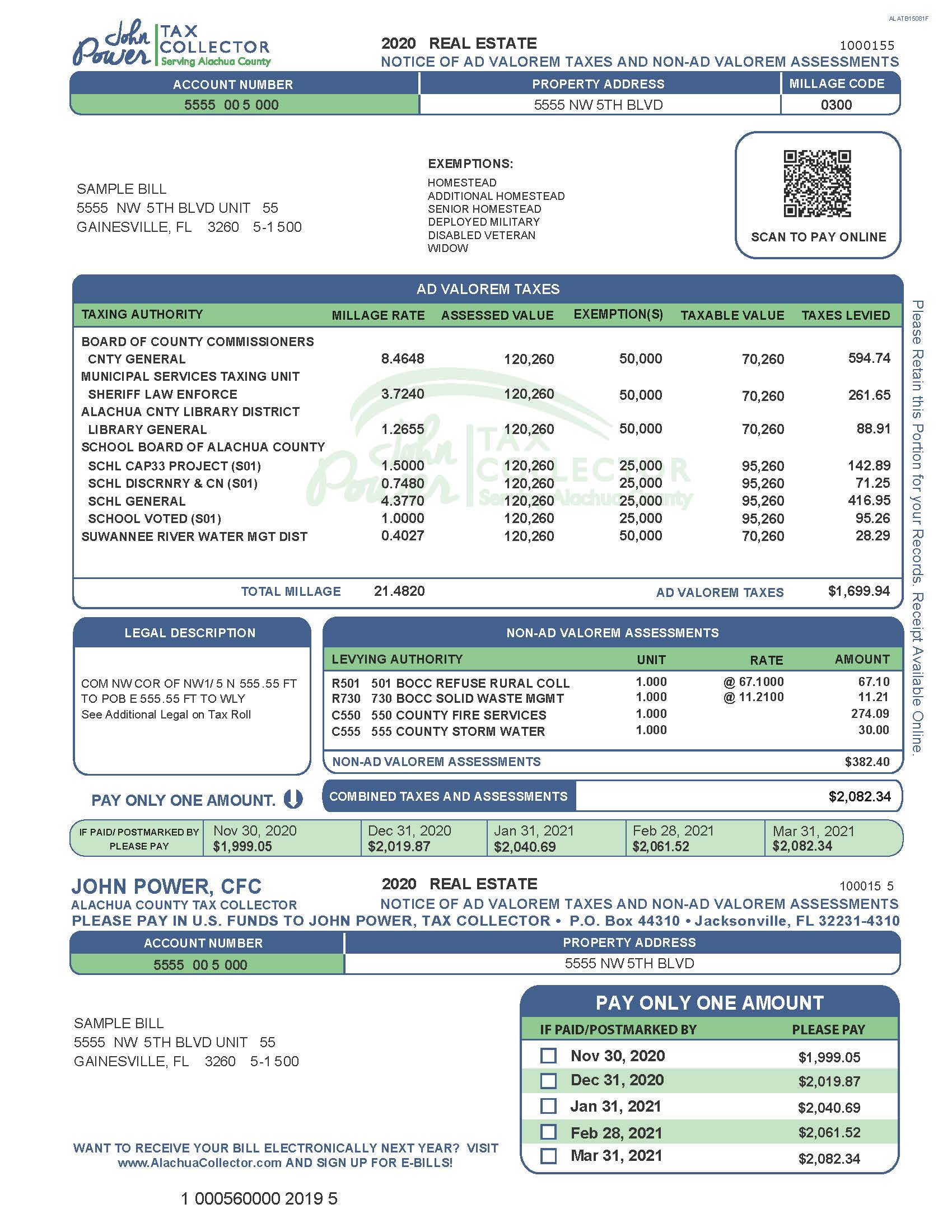

A Guide To Your Property Tax Bill Alachua County Tax Collector

What Are Marriage Penalties And Bonuses Tax Policy Center

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Property Taxes Calculating State Differences How To Pay

Property Taxes Calculating State Differences How To Pay

What Is A Homestead Exemption And How Does It Work Lendingtree

Your Guide To Prorated Taxes In A Real Estate Transaction

Tax Implications Of Canadian Investment In A Florida Rental Property Madan Ca

Florida Income Tax Calculator Smartasset

Things That Make Your Property Taxes Go Up

Tax Implications Of Canadian Investment In A Florida Rental Property Madan Ca

Tax Implications Of Canadian Investment In A Florida Rental Property Madan Ca